Navigating the world of taxes can be daunting, especially when you factor in the cost of professional tax preparation. Fortunately, for residents of Richmond, VA, there are numerous options for free tax preparation services. Whether you have a simple or complex tax situation, these resources can help you file accurately and maximize your refund without breaking the bank.

Why Choose Free Tax Preparation?

Benefits of Free Tax Preparation

Benefits of Free Tax Preparation

Free tax preparation services offer a lifeline for individuals and families with low-to-moderate incomes. These programs are designed to help you navigate the complexities of the tax code, ensuring you claim all eligible deductions and credits.

Here are some compelling reasons to consider free tax preparation:

- Save Money: The most obvious benefit is the cost savings. Professional tax preparation fees can significantly eat into your refund.

- Accuracy: Volunteers and certified tax preparers are trained to provide accurate filing assistance, reducing the risk of errors.

- Maximize Your Refund: Free tax preparation services help you claim all eligible deductions and credits, ensuring you receive the maximum refund possible.

- Peace of Mind: Knowing your taxes are filed correctly provides invaluable peace of mind.

Where to Find Free Tax Preparation in Richmond, VA

Richmond offers a variety of options for free tax assistance. Here are some key resources:

Volunteer Income Tax Assistance (VITA)

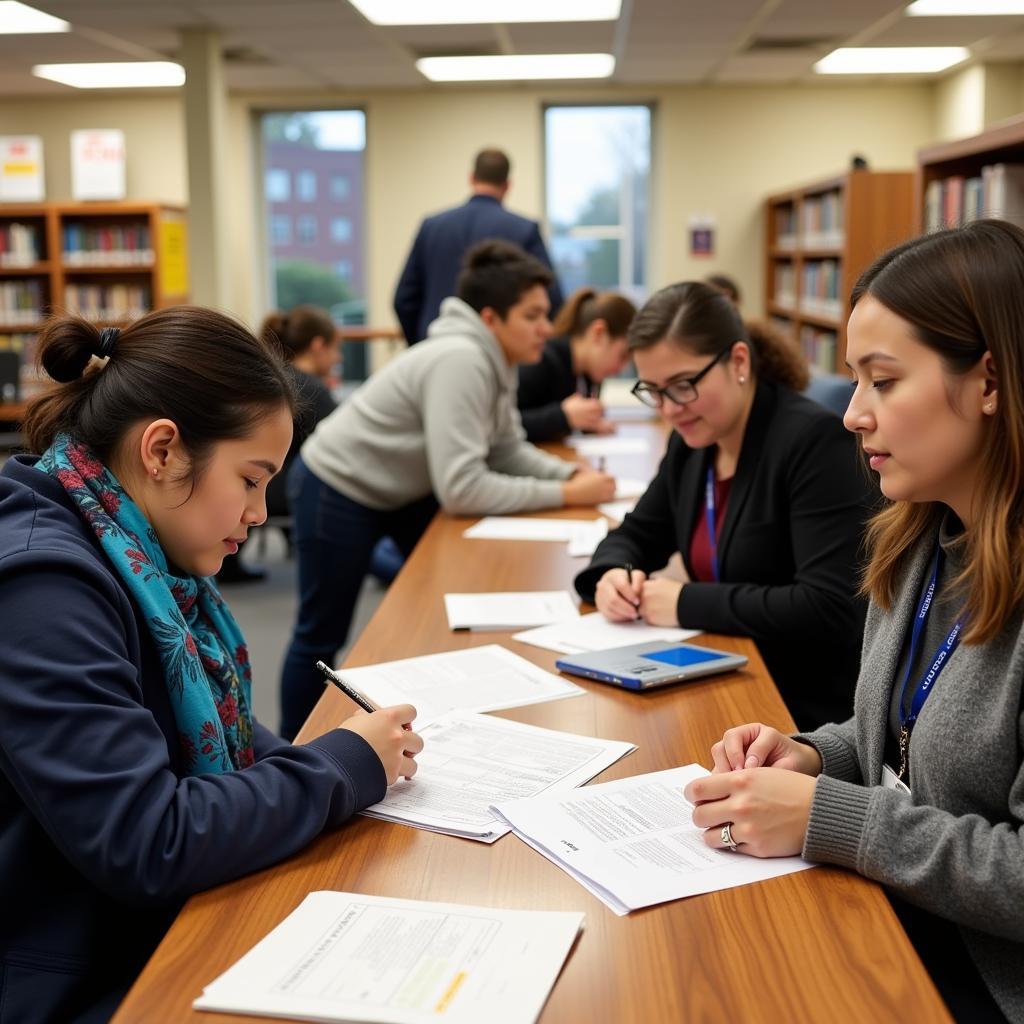

VITA Program Location in Richmond

VITA Program Location in Richmond

VITA is a nationwide program offering free tax help to individuals and families with low-to-moderate incomes, persons with disabilities, and limited English-speaking taxpayers.

Who is eligible? Generally, individuals earning $58,000 or less, persons with disabilities, and limited English-speaking taxpayers qualify for VITA assistance.

Where to find VITA sites in Richmond: You can locate a VITA site near you by using the IRS’s VITA Locator tool on their website.

Tax Counseling for the Elderly (TCE)

The TCE program provides free tax help to individuals aged 60 and older, specializing in questions about pensions and retirement-related issues.

Who is eligible? Anyone aged 60 or older, regardless of income, can take advantage of TCE services.

Where to find TCE sites in Richmond: You can use the IRS’s online locator tool or contact your local senior center.

AARP Foundation Tax-Aide

Similar to VITA, the AARP Foundation Tax-Aide program offers free tax assistance to taxpayers with low-to-moderate incomes, with a special focus on those aged 50 and older.

Who is eligible? While the program prioritizes those over 50, there are no specific age or income restrictions.

Where to find AARP Foundation Tax-Aide sites: Visit the AARP Foundation website or call their toll-free number to find a location near you.

What to Bring to Your Free Tax Preparation Appointment

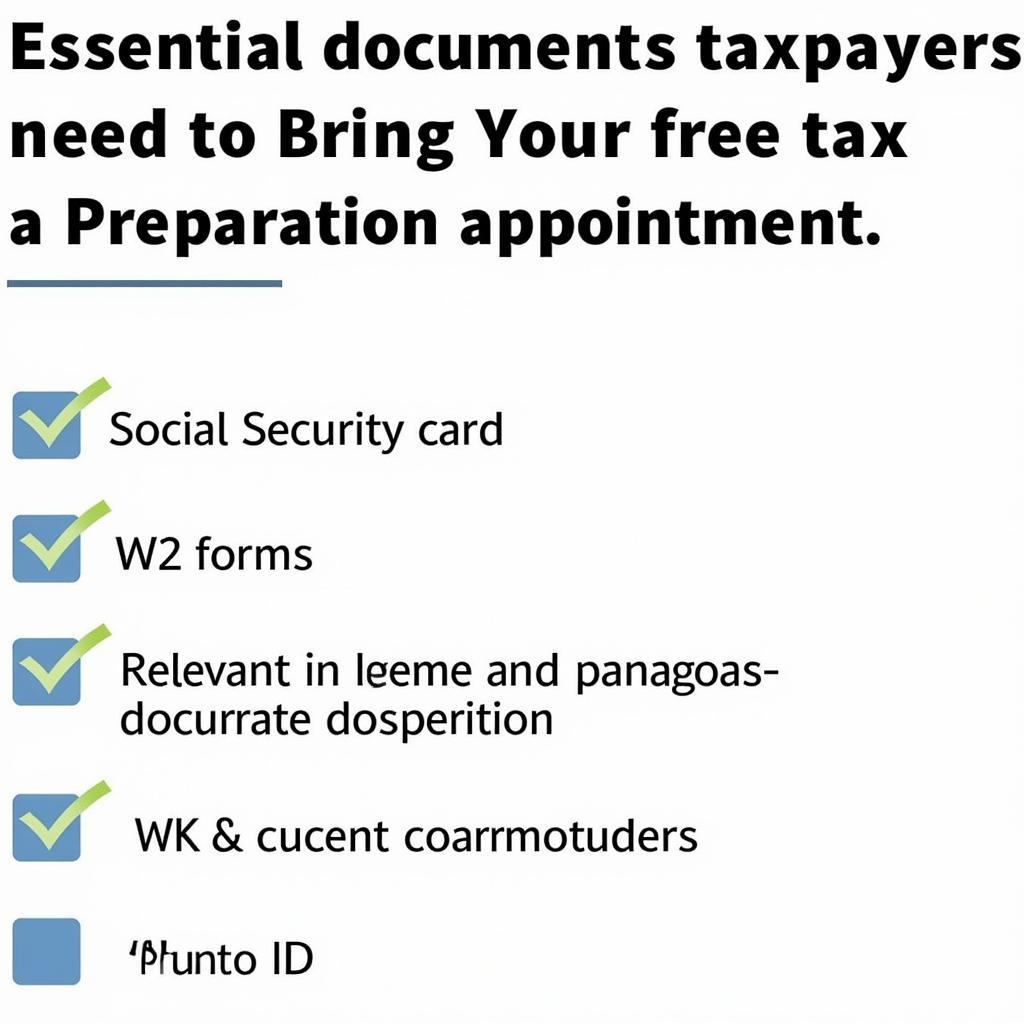

Essential Documents for Tax Filing

Essential Documents for Tax Filing

To ensure a smooth tax preparation experience, make sure to gather the following documents:

- Social Security Cards: Bring Social Security cards for yourself, your spouse, and any dependents.

- Photo ID: A government-issued photo ID is required.

- Income Documents (W-2, 1099, etc.): Gather all forms reflecting your income for the year.

- Expense Documents (if applicable): If you plan to itemize, bring documentation for deductible expenses, such as medical expenses or charitable contributions.

- Prior Year’s Tax Return: Having your previous year’s return can be helpful for the tax preparer.

Tips for Choosing a Free Tax Preparation Service

- Check Qualifications: Ensure the organization and its volunteers are IRS-certified and trained in current tax law.

- Consider Your Needs: Choose a program that aligns with your specific tax situation, such as VITA for low-to-moderate income or TCE for seniors.

- Schedule an Appointment: Many sites operate on an appointment-only basis, so it’s best to call ahead and reserve your spot.

- Review Before Filing: Always carefully review your completed tax return before it’s filed electronically or mailed to the IRS.

Conclusion

Finding reliable and free tax preparation services in Richmond, VA, is easier than you might think. By taking advantage of these resources, you can fulfill your tax obligations accurately and potentially increase your refund. Remember to gather all necessary documents and choose a reputable program to ensure a stress-free tax season.

FAQ

1. What if I can’t make it to a free tax preparation site?

The IRS offers free online filing options through its Free File program for taxpayers with adjusted gross incomes below a certain threshold.

2. What if my tax situation is complex?

While free tax preparation services can handle many common tax scenarios, extremely complex situations may require the expertise of a paid professional.

3. Can I get help with amending a previous tax return?

Yes, some free tax preparation sites can assist with amending previous returns.

4. How are these programs funded?

VITA, TCE, and AARP Foundation Tax-Aide are funded through grants and donations.

5. How far in advance should I schedule my appointment?

It’s recommended to schedule your appointment as early as possible, as slots tend to fill up quickly, especially closer to the tax deadline.

Need Help?

For immediate assistance with your tax preparation needs in Richmond, VA, contact us at:

Phone Number: 0972669017

Email: [email protected]

Address: 142 Trần Nhân Tông, Yên Thanh, Uông Bí, Quảng Ninh, Việt Nam

Our dedicated customer support team is available 24/7 to answer your questions and guide you towards the resources you need.