A Free Cash Flow Yield Screener is a powerful tool for investors seeking companies with strong financial health and the potential for future growth. It allows you to quickly sift through mountains of financial data and identify companies generating significant free cash flow (FCF) relative to their market value. But what exactly is free cash flow yield, and how can you effectively use a screener to make informed investment decisions?

Understanding Free Cash Flow Yield

Free cash flow represents the cash a company has left over after covering its essential operating expenses and capital expenditures. It’s the cash flow a company can use to pursue opportunities that enhance its business, like paying dividends, buying back stock, reducing debt, or pursuing acquisitions.

Free cash flow yield takes this concept a step further by measuring a company’s free cash flow relative to its current market valuation. This metric provides a valuable way to assess whether a company’s stock is overvalued or undervalued.

Calculating Free Cash Flow Yield:

Free Cash Flow Yield = (Free Cash Flow / Market Value) x 100Where:

- Free Cash Flow: Found on a company’s cash flow statement.

- Market Value (or Market Capitalization): Calculated as the current share price multiplied by the total number of outstanding shares.

A high free cash flow yield suggests a company is generating ample cash compared to its size, indicating a potentially undervalued investment opportunity.

The Power of a Free Cash Flow Yield Screener

Manually calculating and comparing the free cash flow yield for numerous companies would be a daunting task. That’s where a free cash flow yield screener proves invaluable. Here’s how these tools can streamline your investment research:

-

Efficient Screening: Quickly filter through thousands of stocks based on specific free cash flow yield criteria.

-

Customizable Parameters: Set your desired free cash flow yield range, market capitalization limits, and other relevant financial ratios to pinpoint companies aligning with your investment strategy.

-

Time-Saving: Eliminate hours spent poring over financial statements. A screener presents a curated list of potential investments that meet your chosen criteria.

-

Comparative Analysis: Easily compare free cash flow yields across different companies or sectors, enabling you to identify relative value opportunities.

-

Uncovering Hidden Gems: Free cash flow yield screeners can help you uncover lesser-known companies with strong fundamentals that might be overlooked by traditional valuation methods.

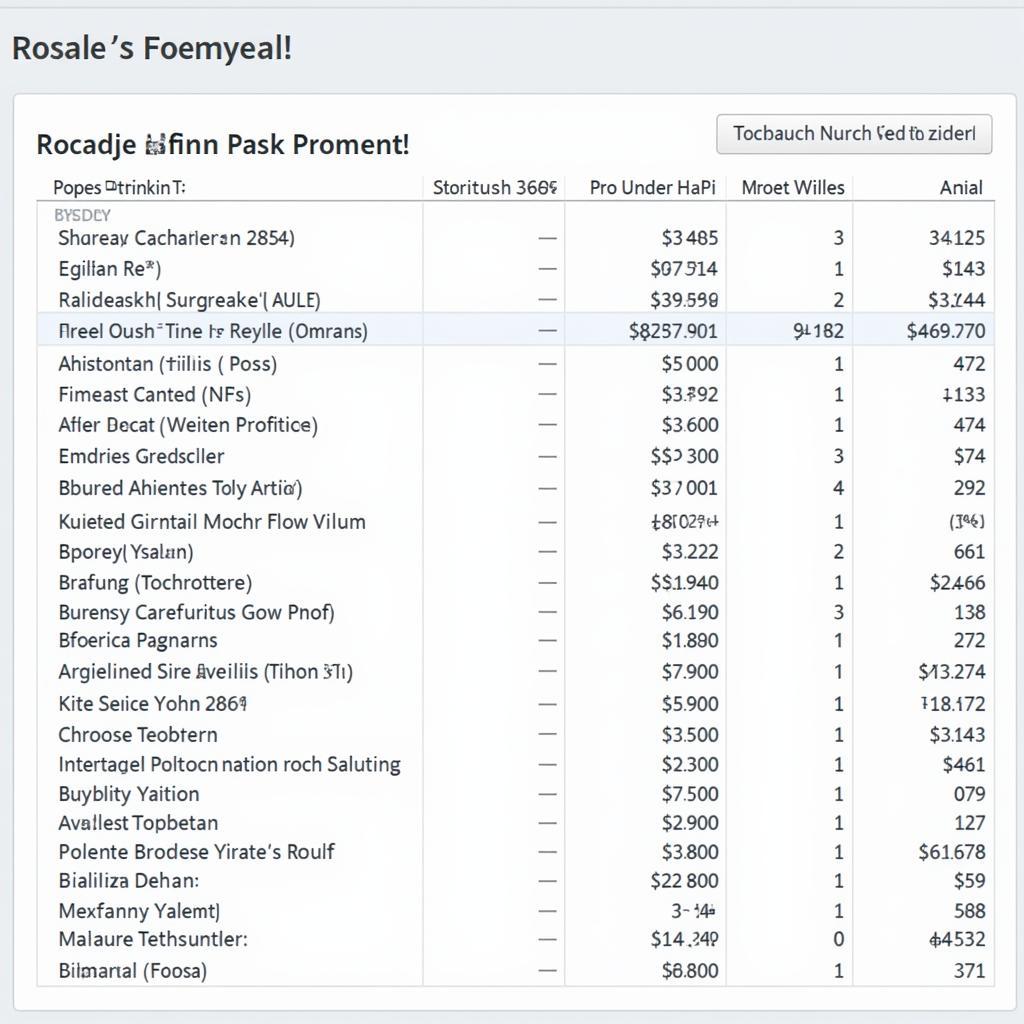

Example of a Free Cash Flow Yield Screener

Example of a Free Cash Flow Yield Screener

How to Effectively Use a Free Cash Flow Yield Screener

While a free cash flow yield screener can be an incredibly powerful tool, it’s essential to use it strategically as part of a broader investment analysis process. Here are some tips:

-

Set Realistic Expectations: No single metric guarantees investment success. Free cash flow yield is just one piece of the puzzle.

-

Combine with Other Metrics: Use free cash flow yield alongside other valuation ratios like price-to-earnings (P/E), price-to-book (P/B), and return on equity (ROE) for a more comprehensive view.

-

Consider Industry Context: Free cash flow yield can vary significantly between industries. What’s considered high in one sector might be average in another.

-

Delve Deeper into Company Fundamentals: Once your screener has generated a list of potential investments, conduct thorough research into each company’s financial statements, management team, competitive landscape, and growth prospects.

-

Monitor Regularly: Financial performance can change over time. Regularly re-run your screens and update your investment thesis based on the latest data.

Beyond the Numbers: Qualitative Factors to Consider

While quantitative metrics like free cash flow yield provide valuable insights, don’t overlook the importance of qualitative factors in your investment decisions. Consider the following:

-

Management Quality: A company’s leadership team plays a crucial role in its ability to generate and allocate free cash flow effectively. Assess the management team’s track record, experience, and capital allocation decisions.

-

Competitive Advantages: Companies with sustainable competitive advantages, such as strong brands, proprietary technology, or significant economies of scale, are better positioned to generate consistent free cash flow over the long term.

-

Industry Trends and Disruptions: Be mindful of the industry dynamics and potential disruptions that could impact a company’s ability to maintain its free cash flow generation in the future.

Analyzing Company Financials alongside Free Cash Flow Yield Data

Analyzing Company Financials alongside Free Cash Flow Yield Data

Finding the Right Free Cash Flow Yield Screener

Numerous online platforms offer free and paid free cash flow yield screeners. When choosing a screener, consider the following factors:

- Data Coverage: Ensure the screener includes a comprehensive database of stocks, including those from different exchanges and market capitalizations.

- Customization Options: Look for a screener that allows you to set specific criteria for free cash flow yield, market cap, and other relevant metrics to align with your investment strategy.

- User Interface: A user-friendly interface can make the screening process more efficient and enjoyable.

- Additional Features: Some screeners offer additional features like charting tools, portfolio tracking, and real-time data updates, which can be valuable for investors.

Conclusion: Empowering Investment Decisions

A free cash flow yield screener can be an invaluable tool for investors seeking to uncover undervalued companies with strong financial foundations. By using this tool strategically alongside thorough research and a holistic understanding of a company’s fundamentals, you can make more informed investment decisions and potentially enhance your portfolio returns.

Remember: Investing involves risk, and past performance is not indicative of future results. Conduct thorough research and consider seeking advice from a qualified financial advisor before making any investment decisions.