Mctc Free Tax services can help you navigate the often-confusing world of tax preparation without breaking the bank. But what exactly does MCTC free tax entail, and who is eligible for this valuable service? Let’s delve into the details and explore how you can benefit from MCTC’s free tax assistance.

Understanding MCTC Free Tax Services

MCTC, short for Minnesota Community Technical College, partners with the IRS to offer free tax preparation services to eligible individuals and families. This program, often referred to as Volunteer Income Tax Assistance (VITA), is designed to help taxpayers with low to moderate income file their federal and state taxes accurately and on time.

Who Qualifies for MCTC Free Tax Help?

Generally, you may qualify for MCTC free tax assistance if you meet the following criteria:

- Income: Your annual household income falls below a certain threshold (typically $60,000 or less).

- Tax Situation: Your tax return is relatively straightforward, without complex investments or business income.

- Age: You may qualify for special assistance if you are a senior citizen or a person with disabilities.

MCTC Free Tax Services

MCTC Free Tax Services

Navigating the MCTC Free Tax Process

Taking advantage of MCTC’s free tax preparation services is a straightforward process:

- Gather Your Documents: Collect all necessary tax documents, including W-2s, 1099s, Social Security numbers, and any other relevant information.

- Locate a VITA Site: Find a convenient MCTC free tax site near you. You can typically find this information on the MCTC website or the IRS website.

- Schedule an Appointment: Contact the VITA site to schedule an appointment. Some locations may accept walk-ins, but it’s always a good idea to call ahead.

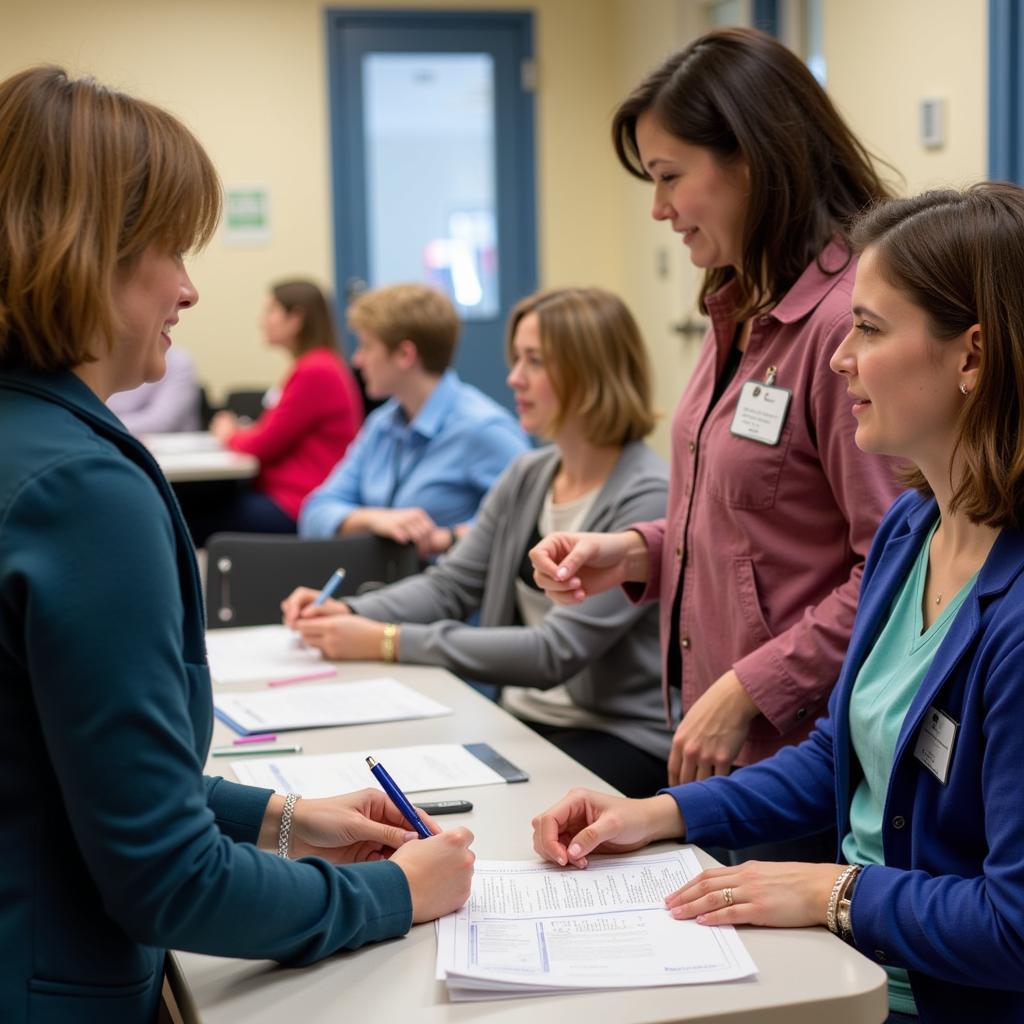

- Meet with a Volunteer Tax Preparer: Bring your documents to your scheduled appointment and meet with a trained volunteer tax preparer. They will guide you through the process, answer your questions, and ensure your tax return is filed correctly.

Benefits of Choosing MCTC Free Tax Services

- Cost Savings: Eliminate the expense of hiring a professional tax preparer.

- Accuracy: Benefit from the expertise of IRS-certified volunteers who are trained to prepare taxes accurately.

- Peace of Mind: Gain confidence knowing that your taxes are filed correctly, reducing the risk of audits or penalties.

- Access to Resources: Receive guidance and information about potential tax credits and deductions that you may qualify for.

Benefits of Free Tax Preparation

Benefits of Free Tax Preparation

MCTC Free Tax: Common Questions and Answers

Q: What if I have a more complex tax situation?

A: While MCTC free tax services cater to individuals with relatively straightforward tax returns, they may be able to refer you to other resources or programs if your situation is more complex.

Q: What if I cannot make it to an MCTC site in person?

A: Explore online tax preparation options available through the IRS Free File program. These online tools guide you through the process and may offer free filing options based on your income and age.

Q: How secure is my information with MCTC free tax services?

A: MCTC and their VITA volunteers prioritize the security and confidentiality of your personal and financial information. They adhere to strict privacy guidelines to ensure your data is protected.

Seeking Further Assistance

For personalized support with your MCTC free tax needs, reach out to our dedicated team.

Contact:

- Phone: 0972669017

- Email: [email protected]

- Address: 142 Tran Nhan Tong, Yen Thanh, Uong Bi, Quang Ninh, Vietnam

Our dedicated customer support team is available 24/7 to answer your questions, address your concerns, and guide you towards a seamless tax filing experience.